Something must be done! Here’s something…

The vast majority of my career has been in competition with Microsoft’s bundled solutions. I do not think that you win by doing what they do, but more expensively. And yet, this happened.

When Microsoft really comes at you, they do it with EEE: Embrace, Extend, Eliminate. It is a wondrously effective strategy for domination in a technical environment. Similar to and possibly inspired by the strangler vine migration strategy, EEE helps companies break each other’s product market fit, by changing the market out from under the product. There are many examples of the strategy recorded out there, but in the spirit of this blog post, let’s look at one that the victim did to themselves: NDS4NT. Microsoft’s entire strategy against Novell NetWare is presented in technology history as an EEE, and this is just one battle of that war, but it was a pivotal battle that still resonates today.

Novell’s NetWare operating system was the services workhorse of the late 1980’s and 1990’s. I learned the basics of operating systems from it, reading the NetWare 3.12 manuals cover to cover and working with a small server for a CPA’s office. It was like a simplified Unix, easy to use but quite scalable for the time. Most importantly, it came with an x.500 LDAP system, called Novell Directory Services (NDS). This meant a NetWare network acted as the organization’s phone book, group membership manager (read: implementation of the org chart), and sign on broker for hundreds of thousands of companies and agencies. It’s a powerful position to start the network effects engine from: running an application on your NetWare server meant you didn’t need to worry about account CRUD (creation, reading, updating, and deletion) for that app: it was done in NetWare. Where to change passwords? One place. Where to grant or deny permissions? One place. How to troubleshoot logins? One starting point. Microsoft obviously needed to take that role in order to displace Novell.

Embrace: As the first step, Windows and its application services were made citizens in good standing of the Novell world. You could run Windows with a purely IPX/SPX network stack, you could log into Windows or a Microsoft service with a NetWare account, and you could browse NetWare services and systems with Microsoft tools. This allowed Microsoft engineers to develop expertise and access design materials, encouraging focus on the problems solved and left unsolved by NDS. This situation lasted for some years, with Microsoft and Novell officially partnering in industry councils like DMTF and IETF.

Extend and Eliminate: The second and third steps went fast; in my memory the action was over inside of a year. Responding to customer demand to make systems interoperable, Novell shipped NDS4NT, a bi-directional bridge that synchronized NDS with Microsoft’s Active Directory. Going from my memories of the VAR (Value Added Reseller) consulting shop where I learned the industry ropes in the late 1990s, San Francisco Bay Area businesses and governments were 60/40% NetWare/Windows. That changed in the blink of an eye with NDS4NT. Once the sync was done, you could safely decommission NetWare. The growing demand for Internet access didn’t help Novell’s case. If you were still on NetWare 3.12 or NetWare 4 and the loose bundle of WordPerfect/Quattro or Lotus/GroupWise, you were facing an upgrade to introduce TCP/IP networking with NetWare 5. Penciling out those upgrades often made Microsoft look cheaper, especially as they learned to bundle Office and Exchange. Losing control of the directory service was the death knell for Novell; customers switched very rapidly. As I changed jobs to a telco division focused on Internet hookups and firewall installations, Novell effectively disappeared. NDS4NT was the final straw. Today, Microsoft’s Active Directory remains the de facto source of organizational truth for all but the most die-hard of anti-MS organizations, and its number one challenger is… Microsoft’s Azure Active Directory.

What do you do when facing this strategy? How can it be defended against? Tough questions indeed, and every real world situation is its own. However, some general principles may apply.

Start with careful monitoring. While hope is not a plan, it’s also true that sustained multi-year execution is actually pretty rare among public titans of our industry. Just because there’s a plan to kill you doesn’t mean they’ll remember to execute after they lay off the folks who were running the tactical project of killing you. That may sound overly snarky, but it happens all the time, particularly when the tactical project is complex. Note that your effort here is not an exercise in ignoring risk, it’s rather about ensuring that risk still exists and you’re not fighting a ghost.

Next, think about where the danger is coming from. Why would your customers pick them instead of you? Is it just the bundled price? Competitors to Microsoft don’t want to think they’re losing because of bundling, because the only single-product defense against that is dropping price. Instead, they may float the idea “we should fight Microsoft at their own game.” While that’s probably a poor plan, it avoids “we have to lower our prices to remain competitive.” This is important because lowering prices is very very difficult, to the point of being a third rail for many companies. Dropping price for new deals isn’t so bad, just publish a new price table, maybe obfuscated with some new licensing. But it won’t be long at all before you’ve got to go back to your old contracts with existing customers and drop all the renewal prices too. Next thing you know NACV (new annual contract value) and ARR (annual recurring revenue) are both in the toilet, you can’t raise money, and people are talking about acquisitions and layoffs.

Declining recurring revenue (or customer churn!) is a financial black hole — every dollar lost is two that have to be made in order to maintain growth towards goals. Reducing price on existing product causes that situation, so you must produce replacement ARR. That means you either produce a really enticing new product… and I mean really finish producing it, not just a launch that your sales people won’t sell. Or more likely, all the ancillary services and content and support for your main product gets a lot more expensive, and your partners get their margins squeezed, and maybe you lay a bunch of folks off.

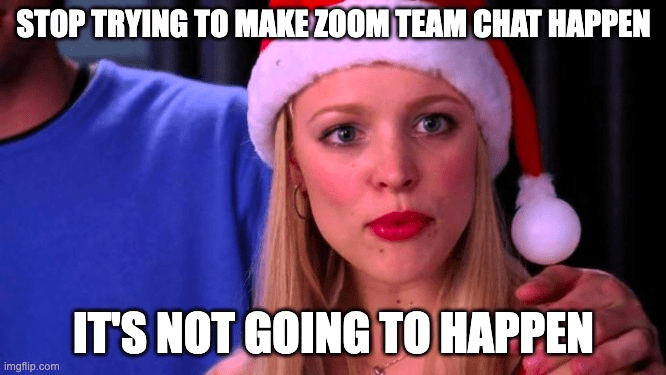

That all sucks a lot, so product teams want to think they’re going to win with features instead of price. The tough thing for a company in Microsoft’s sights is, you’ve been doing so well. Microsoft wouldn’t waste their time bundling a feature to fight you if you’re not nibbling at their budget. So you want to double down on your main product, finish your roadmap and then some. Maybe expand the product into vaguely adjacent product areas. You want to compete, but it’s easy for “compete with the Microsoft bundle” to turn into “throw stuff at the wall and see what sticks”. For instance, Zoom, which is responding to Microsoft Teams by sticking all sorts of wacky stuff into its product. Now there’s team chat, a marketplace with music apps, now there’s file sharing, now there’s mail and calendar!

Or maybe you go toe to toe, and add features to match the Microsoft example. For instance Slack, which is doing things like blurring workspace boundaries. This path is less likely to make happy users (I’ve found two positive opinions in informal survey of dozens, both independent consultants). I presume Slack can find customers who say they want it because the research is taking place in a market where Microsoft’s being selected by people for whom usability is not the only concern. In this case, “compete with the Microsoft bundle” becomes “copy the features of the Microsoft offering”. This is a mistake: if you find it hard to explain internally why it’s suddenly necessary to follow Microsoft instead of your customers, that’s a sign you’re going the wrong way. In my opinion this is related to a product management problem that occurs at scale… when you’ve got enough customers, you can find users to listen to that will support whatever pre-conceived notion you bring to the table. See? WE ARE LISTENING TO THE USERS. Data rarely tells clear stories that are impossible to bias, particularly in domains where the measurable points are all proxies to real intent.

Few product teams consciously decide to copy Microsoft features just because it’s beating their product. But, what if it’s true that Microsoft has the pulse of buyers you’re not talking to? For all of their flaws, Microsoft very clearly does understand the needs of a whole lot of buying customers. In fact, a lot of their flaws come from that understanding: The MS bundle is easy to buy (especially at scale), easy to hire for, and old stuff will remain supported practically forever. Those are positive attributes to the corporate buyer, no matter how much grief they produce for the people who work the front lines. Furthermore, Microsoft is not always wrong: for instance while it certainly was larded with lock-ins, MSIE introduced a lot of valuable features as well. Not implementing those at all wouldn’t help a browser maintain position against MSIE.

Therein lies the problem… once the EEE machine starts turning, customer demands start to adjust. Whether they need or want the features in the Microsoft bundle, those features are going to affect vendor managers and procurement systems, analyst definitions of the marketplace, and the offerings of other competitors in the space. Three years after the thing is bundled into a Microsoft E-ticket, its features are the official table stakes in RFPs (Requests for Proposals), whether they’re actually used or not. And that’s why come super-effective vendors help their customers write RFPs.

A better path to holding your own against the Goliath is just that: stay true to your own path. I once worked with Kelly Moore Paints as a customer. A lot of IT shops feel like rooms from the same building, full of dashboards, memes, and mission statements, and sure, that was all there. But they also had a large banner that dominated the room: Make Paint, Sell Paint. That admirable level of focus was apparent through the process of buying and deploying and using the solution: how would the things we were doing help to make or sell paint? A software vendor competing with Microsoft’s embrace cannot lose that level of focus: make customer value, sell that value.

Back to the feature explosion from Microsoft entering your market. You need to treat externally introduced feature requirements like any other analyst’s fever dream or government regulation induced gate. You have to do something, but you don’t always have to do a lot. If your customers don’t actually want it, then it is a checkbox to clear (think two person weeks) rather than a point of focus (think two development teams). Think about default states: is it better to set the new thing to off so it doesn’t disturb paying customers? Note, the answer is probably “no” for regulation-induced requirements. Depending on your maturity level as an organization, you might even be able to allocate budget slices to this process and produce a gradual roadmap to that full slate of checkboxes.

This level of competition comes with a hard adjustment though: the air has been reduced in the room where your product lives. Growth for that product will almost certainly slow, so if your finances are dependent on a hockey stick trajectory, you need a new product to drive that business. Getting that new business going can be good, bad, or ugly. If it doesn’t happen, you’re headed for lifestyle business at best, refinancing at worst (almost certainly acquisition, probably by private equity).